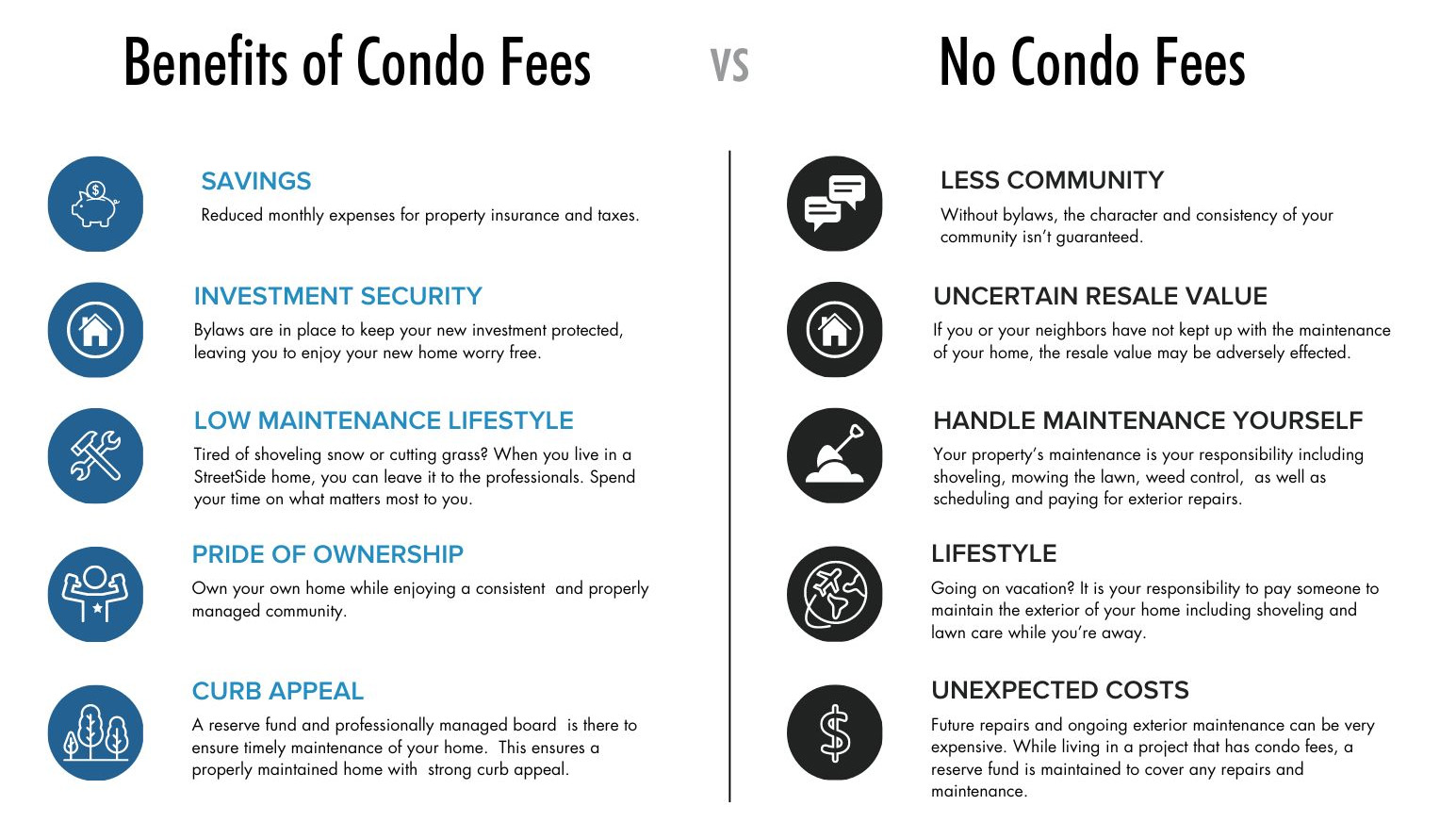

Take a moment to review the information below to learn more about the benefits of a maintenance free community and why they’re often a better choice for your new home.

Condo Fee FAQ

We know you have lots of questions about living in a maintenance free condo fee StreetSide home, so we’ve put together some of our most frequently asked questions for you!

What is a Condominium Corporation?

Legally speaking, a condominium is a form of property ownership with Condo Contributions, also known as Condo Fees, ownership is broken into two parts. For one part, you own the legal title to the apartment or townhome unit, meaning you own and are responsible for maintaining and repairing everything inside the home itself.

The second part is the joint ownership of what’s called the common property, you own this in partnership with the other owners in the area. This includes things like shared land, hallways, landscaped areas, and the exteriors of the homes.

When we build a new condominium community we form something called a Condominium Corporation which is an entity that will help manage the maintenance of the property on behalf of all the owners. This corporation will be governed by owners that are elected to the Condo Board.

What does a Condominium Corporation do?

The corporation is responsible for arranging for the maintenance of the common property, and organizing things like insurance, landscaping, garbage collection, snow removal and repair to the common area. In some cases, the corporation will cover more, but this varies based on each condominium community.

What are Condo Fees?

To get the money to pay for all of the benefits of a condominium, the Condominium Corporation will collect contributions, or Condo Fees, from all of the homeowners. No one living in the condominium community is exempt from these fees.

How are Condo Fees calculated?

When we create a new project, we work with the property manager to create a budget based on an estimate of the operating expenses of the corporation for the first years activities. The estimate is based on their years of experience running similar multifamily projects in the Winnipeg area.

We create this budget to try and ensure that we’re setting up the condominium community for long term success, which includes an amount that is contributed to a reserve fund, which is a nest egg to ensure the corporation can pay for future repairs.

Why do you build Condo Fee homes?

When a new area of the city is developed it is a requirement from the city to have some land designated for condominium properties. This is to give the community a wide array of housing options and make home ownership affordable for all.

We develop condominium communities in order to provide a lifestyle that can’t be obtained through standard ownership. Contributing a small fee for a lock and leave, maintenance free lifestyle means you have more time to do the things you love!

If you have any more questions about Condo Fees – Send us an email and we’d be happy to discuss!